NOTICE OF | | |

ANNUAL MEETING | | |

OF STOCKHOLDERS | | |

AND PROXY STATEMENT | | |

| | |

2021 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | ☐ | AMBASE CORPORATIONFee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

| | (1) | 7857 West Sample Road, Suite 134Title of each class of securities to which transaction applies:

|

| | (2) | Coral Springs, FL 33065Aggregate number of securities to which transaction applies:

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 011 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing: |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

AMBASE CORPORATION

7857 West Sample Road, Suite 134

Coral Springs, FL 33065

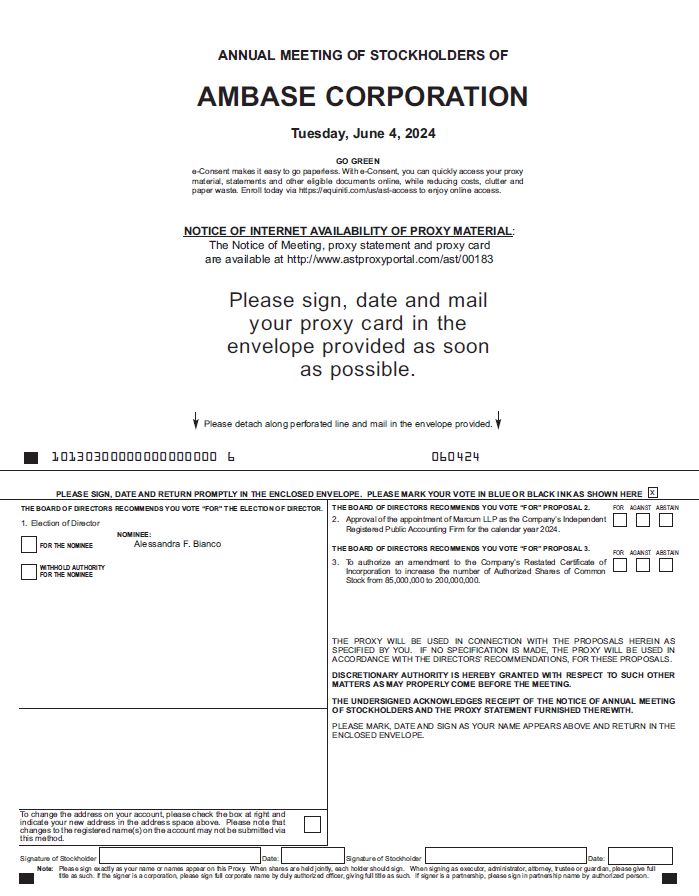

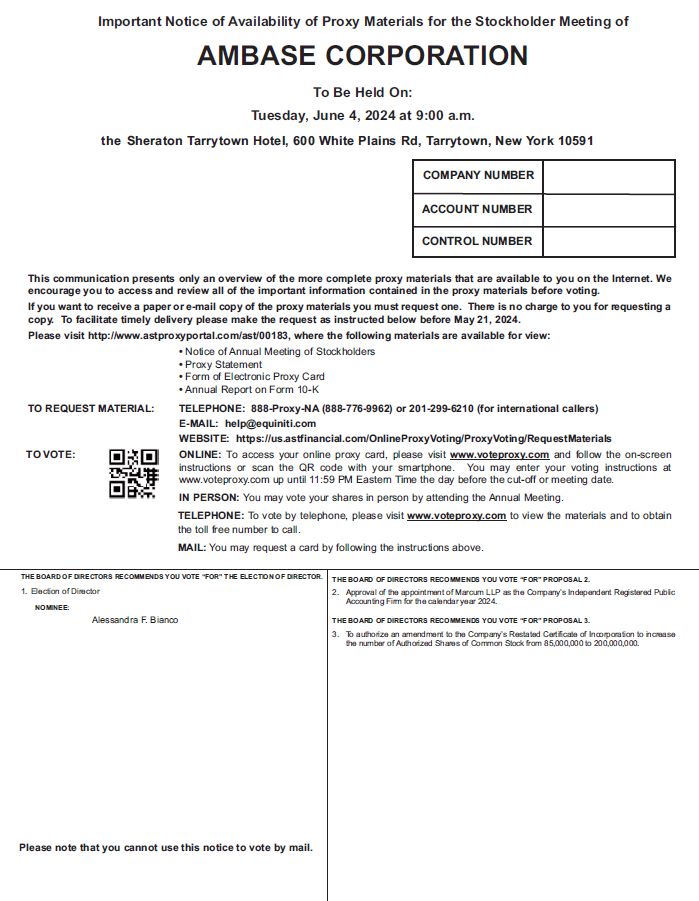

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 3, 20214, 2024

The 20212024 Annual Meeting of Stockholders (the “Annual Meeting”) of AmBase Corporation (the “Company”) will be held at the Hyatt RegencySheraton Tarrytown Hotel, 1800 East Putnam Avenue, Greenwich, Connecticut,600 White Plains Road, Tarrytown, New York, on Thursday, June 3, 20214, 2024, at 9:00 a.m., Eastern Daylight Time, to consider and act upon the following matters:

1. | The election of two directorsone director to hold office for a three-year term expiring in 2024; 2027; | |

2. | The ratification of the appointment of Marcum LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2021;2024; | |

| 3. | To authorize an Amendment to the Company’s Restated Certificate of Incorporation to increase the number of shares of authorized shares of common stock from 85,000,000 to 200,000,000 (a copy of which is attached as Exhibit A to the Proxy Statement); |

and such other matters as may properly come before the Annual Meeting or any adjournments thereof.

The Board of Directors has fixed the close of business on Wednesday,Monday, April 14, 202115, 2024, as the record date (the “Record Date”) for determining stockholders entitled to notice of and to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 3, 20214, 2024. This Proxy Statement, the Notice of Annual Meeting of Stockholders and our Annual Report to Stockholders are available at http://www.proxyvote.com.www.proxyvote.com. The Company intends to mail the Notice of Annual Meeting and accompanying Proxy Statement to stockholders on or about the Record Date.

Whether or not you plan to attend the Annual Meeting, please sign, date and return the enclosed proxy card in the prepaid envelope provided, as soon as possible, so your shares can be voted at the meeting in accordance with your instructions. If you prefer, you may instead vote electronically through the internet or by telephone. The instructions on your proxy card describe how to use these convenient services. Your vote is important no matter how many shares you own. If you plan to attend the Annual Meeting and wish to vote your shares personally, you may do so at any time before your proxy is voted. Your prompt cooperation is greatly appreciated.

All stockholders are cordially invited to attend the Annual Meeting.

Admission to Annual Meeting

Attendance at the Annual Meeting is limited to shareholders of the Company as of the Record Date. For safety and security reasons, video and audio recording devices and other electronic devices will not be allowed in the meeting. If your shares are held in the name of your bank, brokerage firm or other nominee, you must bring to the Annual Meeting, a copy of your proxy card, an account statement, or a letter from the nominee indicating that you beneficially owned the shares as of the Record Date for voting. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting.

For registered shareholders, a copy of your proxy card can serve as verification of stock ownership. Shareholders who do not present a copy of their proxy card at the Annual Meeting will be admitted only upon verification of stock ownership, as indicated herein. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting. In addition, all Annual Meeting attendees will be asked to present valid government-issued photo identification, such as a driver’s license or passport, as proof of identification before entering the Annual Meeting, and attendees may be subject to security inspections.

By Order of the | | |

Board of Directors | | |

| | |

/s/ John Ferrara | | |

John Ferrara | | |

Secretary | | |

| | |

AMBASE CORPORATION

7857 West Sample Road, Suite 134

Coral Springs, FL 33065

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 3, 20214, 2024

PROXY STATEMENT

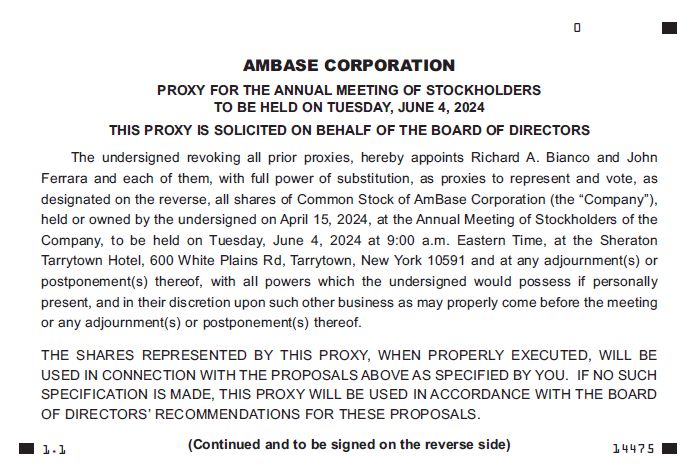

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of AmBase Corporation (the “Company”) of proxies to be voted at the Annual Meeting of Stockholders of the Company (the "Annual“Annual Meeting”) to be held at the Hyatt RegencySheraton Tarrytown Hotel, 1800 East Putnam Avenue, Greenwich, Connecticut,600 White Plains Road, Tarrytown, New York at 9:00 a.m., Eastern Daylight Time, on Thursday, June 3, 20214, 2024, and at any adjournment or postponement thereof. This Proxy Statement and the accompanying proxy are being mailed to stockholders commencing on or about the Record Date.

Shares represented by a duly executed proxy in the accompanying form received by the Company prior to the Annual Meeting will be voted at the Annual Meeting in accordance with instructions given by the stockholder in the proxy. Any stockholder granting a proxy may revoke it at any time before it is exercised by granting a proxy bearing a later date, by giving notice in writing to the Secretary of the Company or by voting in person at the Annual Meeting.

At the Annual Meeting, the stockholders will be asked: (i) to elect Ms. Alessandra F. Bianco and Mr. Jerry Y. Carnegie, as directorsa director of the Company to each serve a three-year termterms ending in 2024;2027; and until their respective successor(s) areher successor is elected and qualified or until theirher earlier resignation, removal or removal; anddeath; (ii) to ratify the approval of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021.2024; and (iii) to authorize an Amendment to the Company’s Restated Certificate of Incorporation to increase the number of shares of common stock from 85,000,000 to 200,000,000 (the “Authorized Capital Increase Charter Amendment,” a copy of which is attached as Exhibit A to the Proxy Statement). The Authorized Capital Increase Charter Amendment does not change the number of authorized shares of cumulative preferred stock from the 20,000,000 shares currently authorized under the Company’s Restated Certificate of Incorporation.

The persons acting under the accompanying proxy have been designated by the Board of Directors and, unless contrary instructions are given, will vote the shares represented by a properly executed proxy (i) for the election of the nomineesnominee for director named above; and (ii) for the approval of the appointment of Marcum LLP as the Company’s independent registered public accounting firm.firm; and (iii) for the authorization of the Authorized Capital Increase Charter Amendment.

If a stockholder is not the record holder, such as where the shares are held through a broker, bank or other financial institution, the stockholder must provide voting instructions to the record holder of the shares in accordance with the record holder’s requirements in order to ensure the shares are properly voted. Your broker will not be permitted to vote on your behalf on the election of directors;the director or the approval of the non-binding advisory vote of the resolution approving the compensation of our Named Executive OfficersAuthorized Capital Increase Charter Amendment unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares. For your vote to be counted, you now will need to communicate your voting decisions to your broker, bank or other financial institution before the date of the stockholders meeting.

The close of business on Wednesday,Monday, April 14, 2021,15, 2024, has been fixed by the Board of Directors as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. Only the holders of record of common stock of the Company, par value $0.01 per share (the “Common Stock”) at the close of business on the record date, are entitled to vote on the matters presented at the Annual Meeting. Each share of Common Stock entitles the holder to one vote on each matter presented at the Annual Meeting. As of Wednesday, March 25, 2021,April [ ], 2024, there were approximately 40,738,000[ ] shares of Common Stock issued and outstanding. The holders of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting shall constitute a quorum. If there is less than a quorum, a majority of those present in person or by proxy may adjourn the Annual Meeting. A plurality vote of the holders of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting, a quorum being present, is required for the election of the director(s).director. The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting, a quorum being present, is necessary for the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm. The affirmative vote of the holders a majority of the shares of Common Stock issued and outstanding as of the Record Date is necessary for the approval of the Authorized Capital Increase Charter Amendment.

In June 2024, after many years of exemplary service, Mr. Jerry Y. Carnegie’s term with the Company’s Board of Directors will expire and he will not stand for re-election. The Board of Directors and the Company thank him for his valuable service.

Abstentions, votes withheld and shares not voted, including broker non-votes, are not included in determining the number of votes cast for the election of the director(s);director; or for the approval of Marcum LLP as the Company’s independent registered public accounting firm.firm, but will have the same effect as a vote against the approval of the Authorized Capital Increase Charter Amendment. Abstentions, votes withheld and broker non-votes, are counted for purposes of determining whether a quorum is present at the Annual Meeting.

PROPOSAL NO. 1 - ELECTION OF DIRECTORSDIRECTOR

In accordance with the method of electing directorsdirector(s) by class with terms expiring in different years, as required by the Company’s Restated Certificate of Incorporation, two directorsone director will be elected at the Company’s 20212024 Annual Meeting of Stockholders to hold office until the Company’s Annual Meeting of Stockholders to be held in 2024.2027. The directorsdirector will serve until his or her successor shall be elected and shall qualify or until his or her earlier resignation, removal, or removal.death.

The personsperson named below havehas been nominated for directorship. The nominees are directorsnominee is a director now in office and havehas indicated a willingness to accept re-election. It is intended that at the Annual Meeting the shares represented by a duly executed accompanying proxy will be voted for the election of the nomineesnominee unless contrary instructions are given. In the event that any of the nominee(s)nominee should become unavailable for election as a director at the time the Annual Meeting is held, shares represented by proxies in the accompanying form will be voted for the election of a substitute nominee selected by the Board of Directors, unless contrary instructions are given or the Board by resolution shall have reduced the number of directors. The Board is not aware of any circumstances likely to render any of the nominee(s)nominee unavailable.

The name, age, principal occupation, other business affiliations, and certain other information concerning the nomineesnominee for election as directorsdirector of the Company areis set forth below.

Alessandra F. Bianco, 4143. Ms. Bianco was elected a director of the Company in November 2012. Ms. Bianco received a Bachelor of Arts at Boston College in 2003. Ms. Bianco worked in the Office of the President at American Bible Society from 2009 through 2013. Prior to her current work, Ms. Bianco worked as an assistant to the Head of the Investment Banking department at Broadpoint Capital. Ms. Bianco is the daughter of Richard A. Bianco, the Chairman of the Board, President and Chief Executive Officer of the Company. Since March 2009, Ms. Bianco has been a senior officer of BARC Investments LLC. Ms. Bianco, through BARC LLC, is one of the largest stockholders of the Company, and thus has a direct interest in the Company optimizing stockholder value. The Board of Directors has determined that Ms. Bianco is well qualified to serve as a member of the Company’s Board of Directors and that she has the requisite experience, qualifications, attributes, and skills necessary to serve as a member of the Board of Directors. If elected, her term will expire in 2024.2027.

Jerry Y. Carnegie, 69. Mr. Carnegie was elected a director of the Company in June 2016, having previously been a member of the Board from January 2009 to June 2015. Mr. Carnegie is a member of the Fellow of Society of Actuaries and a Certified Financial Planner. For the last several years he has worked independently assisting individuals with financial planning. Mr. Carnegie spent 25 years with Hewitt Associates as a Senior Actuary, representing major corporations in their pension and benefit plan work. Mr. Carnegie received an A.B. Mathematics degree from Princeton University. Mr. Carnegie’s financial expertise, background in financial planning and pension and benefit consulting provides the board with insight into financial decisions and financial considerations, as well as a valuable perspective to the Company’s financial matters and proceedings. The Board of Directors has determined that Mr. Carnegie is well qualified to serve as a member of the Company’s Board of Directors and that he has the requisite experience, qualifications, attributes and skills necessary to serve as a member of the Board of Directors. If elected, his term will expire in 2024.

Information Concerning Directors Continuing in Office

Certain information concerning the directors of the Company whose terms do not expire in 20212024 and who are continuing in office is set forth below.

Richard A. Bianco, 73.75. Mr. R. A. Bianco was elected a director of the Company in January 1991, and has served as President and Chief Executive Officer of the Company since May 1991. On January 26, 1993, Mr. R. A. Bianco was elected Chairman of the Board of Directors of the Company. He served as Chairman, President and Chief Executive Officer of Carteret Savings Bank, FA (“Carteret Savings” or “Carteret”), then a subsidiary of the Company, from May 1991 to December 1992. Mr. R. A. Bianco has a unique background as the former President and Chief Executive Officer of Carteret Savings who was responsible for the Carteret Savings recapitalization efforts. Mr. R. A. Bianco is the father of Alessandra F. Bianco and Richard A. Bianco, Jr., both of whom are members of the Board of Directors of the Company. Mr. R. A. Bianco has detailed knowledge of the Company’s history including detailed knowledge of its current and prior legal and governmental proceedings. Mr. R. A. Bianco additionally has knowledge in real estate, real estate investing and a background in lending and capital raising. Based on these attributes combined with his prior investment banking, managerial and leadership experience, the Board of Directors has determined that Mr. R. A. Bianco is uniquely qualified to serve as a Director and the Chairman of the Company’s Board of Directors and that he has the requisite experience, qualifications, attributes, and skills necessary to serve as a member of the Board of Directors. His term will expire in 2023.2026.

Richard A. Bianco, Jr., 3739. Mr. Bianco, Jr. was elected a director of the Company in June 2016. Mr. Bianco, Jr. received a Bachelor of Science degree in Finance at Boston College in 2006. Mr. Bianco, Jr. has been working with the Company since September 2006. Prior to his work with AmBase, Mr. Bianco, Jr. worked for UBS Financial Services. Mr. Bianco, Jr. is the son of Richard A. Bianco, the Chairman of the Board, President and Chief Executive Officer of the Company. Mr. Bianco, Jr. is a senior officer of BARC Investments LLC. Mr. Bianco, Jr., through BARC LLC, is one of the largest stockholders of the Company and has a direct interest in the Company optimizing stockholder value. The Board of Directors has determined that Mr. Bianco, Jr. is well qualified to serve as a member of the Company’s Board of Directors and that he has the requisite experience, qualifications, attributes and skills necessary to serve as a member of the Board of Directors. His term will expire in 2022.2025.

KennethScott M. Schmidt, 76.Salant, 58. Mr. SchmidtSalant was elected a director of the Company in March 2013.January 2023. He is a partner at the firm, DelBello Donnellan Weingarten Wise & Wiederkehr LLP, based in White Plains, New York. Mr. Schmidt was formerlySalant is a Managing Directorgraduate of Dillon Read & Co.,the University of Chicago and UBS. Prior thereto, he held various institutional sales positionsthe Boston University School of Law and was also a Captainhas practiced in the United States Air Forcearea of commercial litigation for several years. Mr. Schmidt had been actively involved withdecades. He is admitted to both the Rutgers University Board previously serving asNew York and Massachusetts bar and has experience in a memberwide range of the Rutgers University Board of Governors. Mr. Schmidt has extensive management, underwriting and trading experiencecommercial litigation areas. He handles cases in a variety of positions. His business experiencejurisdictions and venues, including state and federal courts, and arbitrations. Mr. Salant has an understanding of the Company’s history including knowledge of its current and prior legal proceedings. Mr. Salant’s current background and legal expertise in many areas of law provides himthe Board with a valuable perspective and insight into the financial markets past trends,legal process and the New York State Courts, which is important to the Company’s current developments and potential future prospects.legal proceedings. The Board of Directors has determined that Mr. Schmidt’s current backgroundSalant is well qualified to serve as a Director of the Company and expertise provides the Board with experience which is important to the Company’s future business prospects and that he has the requisite experience, qualifications, attributes, and skills necessary to serve as a member of the Board of Directors. His term will expire in 2023.2025.

Information Concerning Executive Officers

For biographical information concerning Richard A. Bianco, see “Information Concerning Directors Continuing in Office”“PROPOSAL NO. 1 - ELECTION OF DIRECTOR” above.

John Ferrara, 5961, Vice President, Chief Financial Officer and Controller. Mr. Ferrara was elected to the position of Vice President, Chief Financial Officer and Controller of the Company in December 1995, having previously served as Acting Chief Financial Officer, Treasurer and Assistant Vice President and Controller since January 1995; as Assistant Vice President and Controller from January 1992 to January 1995; and as Manager of Financial Reporting from December 1988 to January 1992.

Joseph R. Bianco, 7678, Treasurer. Mr. J. Bianco was elected to the position of Treasurer of the Company in January 1998. He has dedicated his career to the financial services and investment industry. Prior to his employment with the Company in 1996, he worked for Merrill Lynch & Co. (“Merrill”) as Vice President, responsible for Sales and Marketing in the Merrill Global Securities Clearing office from 1983 to 1996. Mr. Joseph R. Bianco and Mr. Richard A. Bianco are related.

Director Qualifications

The Company’s equity securities are not currently traded on a national securities exchange and therefore the Company is not subject to any independence standards for directors, including without limitation the independence standards of any national securities exchange that are required by RuleRules 10A-3 and 10C-1 promulgated under the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”). However, the Board of Directors has determined that two of its directors, Messrs. Carnegie and Schmidt, would qualify as independent directors under the NASDAQ stock market rules. For more information about policies and procedures of the Board of Directors relating to actual or potential conflicts of interest and the review and approval of related person transactions, see “Certain Relationships and Related Party Transactions.”

INFORMATION CONCERNING THE BOARD AND ITS COMMITTEES

Meetings and Attendance

During 2020,2023, the Company’s Board of Directors held two (2) meetings. Matters were also addressed by unanimous written consent in accordance with Delaware law seven (7)six (6) times. All directors attended at least 75% of the meetings of the Board of Directors and the committees of the Board on which they served during 2020.2023.

Committees of the Board

In 2020,2023, the Board of Directors had (i) an Accounting and Audit Committee and (ii) a Personnel Committee.

The Company is not a “listed issuer” as such term is defined in Rule 10A-3 of the Exchange Act and is not required to provide the disclosure set forth under Item 407(d)(4) of Regulation S-K. The Accounting and Audit Committee met one (1) time during 2020.2023. Matters were also addressed by unanimous written consent in accordance with Delaware law three (3) times. Mr. Schmidt was a member of the Accounting and Audit Committee until the end of his term in June 2023. The Accounting and Audit Committee currently consists of Mr. Carnegie, Chairman, Ms. Bianco and Mr. Schmidt.Salant. The Board of Directors determined Mr. Carnegie is an “audit committee financial expert” as that term is defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission (the “SEC”).

The Accounting and Audit Committee is directly responsible for the appointment, compensation and oversight of the audit and related work of the Company’s independent auditors. The Accounting and Audit Committee reviews the degree of the independence of the independent auditors; approves the scope of the audit engagement, including the cost of the audit; approves any non-audit services rendered by the auditors and the fees for these services; reviews with the auditors and management the Company’s policies and procedures with respect to internal accounting and financial controls and, upon completion of an audit, the results of the audit engagement; and reviews internal accounting and auditing procedures with the Company’s financial staff and the extent to which recommendations made by the independent auditors have been implemented. The Accounting and Audit Committee has adopted a charter, which has been approved by the Company’s Board of Directors. A copy of the Audit Committee Charter wasis included as Exhibit A to the Company’s 2020this Proxy Statement.

The Personnel Committee held two (2) meetings in 2020. Matters were also addressed by unanimous written consent in accordance with Delaware law one (1) time.meeting in 2023. The Company is not a “listed issuer” as such term is defined in Rule 10C-1 of the Exchange Act. The Personnel Committee currently consists of Mr. Schmidt,Salant, Chairman, and Mr. Carnegie. Mr. Schmidt served as the Chairman of the Personnel Committee until the end of his term in June 2023.

The principal functions of the Personnel Committee, which is equivalent to compensation and nominating committees, are to consider and recommend nominees for the Board, to oversee the performance and approve the remuneration of officers and senior employees of the Company and its subsidiaries and to oversee and approve the employee benefit and retirement plans of the Company and its subsidiaries. The Personnel Committee is also responsible for reviewing and approving the goals and objectives relevant to compensation of officers and senior employees, evaluating their performance in light of those goals and objectives and determining and approving their compensation levels based on this evaluation. The Personnel Committee is responsible for setting and approving salary, bonus and other employment terms for the Company’s Chief Executive Officer. The Chief Executive Officer recommends salary and bonus awards for other officers of the Company, which are subject to modification and/or approval by the Personnel Committee. In connection therewith, the Personnel Committee approves and makes recommendations with respect to bonus and incentive-based compensation plans and equity basedequity-based plans. The Personnel Committee will consider stockholder recommendations for director, submitted in accordance with the Company’s By-Laws. The Personnel Committee does not currently have a written charter.

The Company’s By-Laws require that in the event a stockholder wishes to nominate a person for election as a director, advance notice must be given to the Secretary of the Company not less than 120 days in advance of the one year anniversary of the date on which the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting of stockholders, except that if no annual meeting was held in the previous year or if the date of the annual meeting has been changed by more than 30 calendar days from the date contemplated at the time of the previous year’s proxy statement, such a proposal must be received by the Company a reasonable time before the solicitation is made. The proposal must include the name and address of the stockholder and of the person to be nominated; a representation that the stockholder is entitled to vote at the meeting and intends to appear in person or by proxy to make the nomination; a description of arrangements or understandings between the stockholder and others pursuant to which the nomination is to be made; such other information regarding the nominee as would be required in a proxy statement filed under the proxy rules as set forth in the Securities Exchange Act; and the consent of the nominee to serve as a director if elected. See “Nomination of Directors” below.

Communications with Directors

In order to provide the Company’s security holders and other interested parties with a direct and open line of communication to the Board of Directors, the Board of Directors has adopted the following procedures for communications to directors. The Company’s security holders and other interested persons may communicate with the Chairman of the Company’s Accounting and Audit Committee, the Chairman of the Personnel Committee, or with the non-management directors of the Company as a group, by mailing a letter addressed in care of the Corporate Secretary, AmBase Corporation, 12 Lincoln Blvd., Suite 202, Emerson, New Jersey 07630.

All communications received in accordance with these procedures will be reviewed initially by the Company’s Secretary and/or other executive officers. The Company will relay all such communications to the appropriate director or directors unless the Secretary determines that the communication:

● | does not relate to the business or affairs of the Company or the functioning or constitution of the Board of Directors or any of its committees; | |

● | relates to routine or insignificant matters that do not warrant the attention of the Board of Directors; | |

● | is an advertisement or other commercial solicitation or communication; | |

● | is frivolous or offensive; or | |

● | is otherwise not appropriate for delivery to directors. | |

The director or directors who receive any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full Board of Directors or one or more of its committees, and whether any response to the person sending the communication is appropriate. Any such response will be made only in accordance with applicable law and regulations relating to the disclosure of information.

The Secretary will retain copies of all communications received pursuant to these procedures for a period of at least one year. The Personnel Committee of the Board of Directors will review the effectiveness of these procedures from time to time and, if appropriate, recommend changes.

Board Attendance at Annual Meetings

We have not established a formal policy regarding director attendance at our annual meetings of shareholders, but our directors generally attend the annual meeting. The Chairman of the Board presides at the Annual Meeting of shareholders, and the Board of Directors holds one of its regular meetings in conjunction with the Annual Meeting of shareholders. Accordingly, unless one or more members of the Board are unable to attend, all members of the Board are expected to be present for the Annual Meeting. Two (2)Four (4) of the five (5) members of the Board at the time of the Company’s 20202023 Annual Meeting of Stockholders attended that meeting either in person or telephonically.

Nomination of Directors

The Personnel Committee has adopted specifications applicable to members of the Board of Directors and for identifying and evaluating nominees for the Board of Directors recommended by the Personnel Committee or by shareholders. The specifications provide that a candidate for director should:

● | have a reputation in the business community for integrity, honesty, candor, fairness, and discretion; | |

● | be knowledgeable in his or her chosen industry or field of endeavor, which field should have relevance to our businesses as would contribute to the Company’s success; | |

● | be knowledgeable, or willing and able to become so quickly, in the critical aspects of our businesses, as well as overall operations; and | |

● | be experienced and skillful in communicating with and serving as a competent overseer, and trusted advisor and confidant to senior management, of a publicly held corporation or other corporation. | |

In addition, nominees for the Board of Directors should contribute to the mix of skills, core competencies and qualifications of the Board through expertise in one or more of the following areas: accounting and finance; the financial industry; international business; mergers and acquisitions; leadership; business and management; strategic planning; government relations; investor relations; executive leadership development; and executive compensation. The Personnel Committee does not have a formal diversity policy, although it considers diversity when it evaluates nominees for the Board of Directors in light of the qualifications summarized above, and endeavors to nominate directors with a broad mix of professional and personal backgrounds. The Personnel Committee will consider nominees recommended by stockholders for election at the 20222025 Annual Meeting of Stockholders that are submitted prior to December 15, 2021,16, 2024, to our Secretary at the Company’s offices, 12 Lincoln Boulevard, Suite 202, Emerson, New Jersey 07630. There are no differences in the manner in which the Personnel Committee evaluates nominee(s)nominees for directors based on whether the nominee is recommended by a shareholder or otherwise. Any recommendation must be in writing and must include a detailed description of the business experience and other qualifications of the recommended nominee as well as the signed consent of the nominee to serve if nominated and elected, so that the candidate may be properly considered. All stockholder recommendations will be reviewed in the same manner as other potential candidates for Board membership.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of the forms filed with the SEC and written representations received by the Company, pursuant to the requirements of Section 16(a) of the Securities Exchange Act, the Company believes that, during 2020,2023, there were no transactions with respect to the Company’s equity securities which were not reported on a timely basis to the SEC, no late reports nor other failure to file a required form by any director or officer of the Company.

Certain Relationships and Related Party Transactions

Pursuant to the Company’s Code of Business Conduct and Ethics (“Code of Conduct”), all employees (including our Named Executive Officers, as defined below) who have, or whose immediate family members have, any direct or indirect financial or other participation in any business that competes with, supplies goods or services to, or is a customer of the Company or its subsidiaries, are required to disclose to us and receive written approval prior to transacting such business. Except for the Participation Interest and the Litigation Funding Agreement discussed below, no such relationships have been reported. Our employees are expected to make reasoned and impartial decisions in the workplace. As a result, approval of a business relationship would be denied if it is believed that the employee’s interest in such a relationship could influence decisions relative to the Company’s business or have the potential to adversely affect the Company’s business or the objective performance of the employee’s work. In addition, the Company’s Code of Conduct requires adherence to a number of other underlying principles which are important to the Company. These items include, but are not limited to, restrictions on disclosure of Company information, insider trading, and the protection and use of Company assets.

The Board of Directors assesses all transactions between the Company and “related persons” as such term is defined in Item 404(a) of Regulation S-K. If a transaction is deemed to be a related party transaction that transaction would be reviewed by the Company’s Board of Directors and approved by the disinterested members of the Board of Directors. See

Participation Interest

For information about Mr. R. A. Bianco’s 10% subordinated interest in 111 West 57th Investment LLC, see “Compensation Narrative – Participation Interest;Interest.”

Litigation Funding Agreement

For information about the Litigation Funding Agreement (the “LFA”) entered into between the Company and “LitigationMr. R. A. Bianco in 2017, see “Compensation Narrative – Litigation Funding Agreement;Agreement.” and “Executive Compensation” - “Operating

Operating Agreement of 111 West 57th Investment LLC”LLC

For information about the Company’s and Mr. R.A. Bianco’s investment interests in 111 West 57th Investment LLC, see “Executive Compensation – Operating Agreement of 111 West 57th Investment LLC.”

Standby Purchase Agreement with BARC Investments, LLC

To provide the necessary cash resources to continue operations and continue the litigation related to the 111 West 57th Property, on April [__], 2024 the Company completed a private placement offering (the “Equity Offering”) of 44,200,460 shares of the Company’s common stock (the “Shares”) to existing shareholders of the Company (the “Equity Offering”) for gross proceeds of approximately $8.8 million before deducting offering expenses as further described in the Company’s Current Reports on Form 8-K as filed with the SEC on February 28, 2024 and April [__], 2024. The Shares were not registered under the Securities Act and will be “restricted securities” under the Securities Act and will generally be subject to a minimum holding period of six months under Rule 144 before the Shares may be resold. The Shares were offered and sold only to existing stockholders of record of the Company as of February 28, 2024 (the “Record Ownership Date”). Each qualifying stockholder was permitted to purchase up to his, her or its pro rata share of the Shares in the Equity Offering, based on the amount of shares of Common Stock owned by such stockholder as of the Record Ownership Date, in an amount equal to up to one hundred and eight and one-half percent (108.5%) of the number of shares of Common Stock beneficially owned by such stockholder as of the Record Ownership Date. The Shares were offered and sold pursuant to a Subscription Agreement (the “Subscription Agreement”) by and between the Company and each subscribing stockholder. In connection with the Equity Offering, the Company entered into a securities standby purchase agreement dated February 28, 2024 (the “SPA”) with BARC Investments, LLC (“BARC”), an affiliate of the Company owned and controlled by Company directors Alessandra F. Bianco and Richard A. Bianco, Jr. Under the terms of the SPA, BARC agreed to act as standby a purchaser for all of the shares of common stock offered in the Equity Offering that were not otherwise subscribed to by other stockholders prior to the Subscription Deadline during the 30-day offering period. For additional information.information about the Equity Offering, including the material terms and conditions of Standby Purchase Agreement and the form of Subscription Agreement, see the Company’s Current Report on Form 8-K as filed with the SEC on February 28, 2024. Pursuant to the terms and conditions of the Standby Purchase Agreement, at the closing of the Equity Offering on April [__], 2024, BARC purchased [_________] shares of Common Stock from the Company at a purchase price of $0.20 per share.

Corporate Governance

In addition to the various procedures followed by the Company’s Board of Directors as described herein, the Company maintains a separate Audit Committee and Personnel Committee. The Company believes the functions of its Board of Directors and existing committees essentially perform the responsibilities of a nominating and a corporate governance committee and therefore, the Company does not maintain these additional separate committees.

Mr. R. A. Bianco, the Company’s President and Chief Executive Officer, also serves as the Chairman of the Company’s Board of Directors. Given the Company’s history, operations and its’ past success in the Supervisory Goodwill litigation, tax and other proceedings, the Company and the Board of Directors believe it is appropriate and most effective for Mr. R. A. Bianco to continue to serve in these dual capacities. These considerations are based on Mr. R. A. Bianco’s combined business experience prior to joining the Company and his responsibilities with the Company for over twenty fivethirty years, including his position as President and Chief Executive Officer of Carteret during 1991 and 1992. The Board of Directors also considered the size of the Company’s operations, cost considerations and the effectiveness of communication between the Company’s management and the Board of Directors.

Risk Oversight

The Board of Directors monitors overall risk and performs risk assessment on a proactive basis by maintaining frequent, informal communications with the Company’s senior management, in addition to formal updates given by management to the Board of Directors during Board of Directors and committee meetings.

The Board of Directors additionally monitors risk through direct interaction with the Company’s senior management and also to a lesser extent direct communication with the Company’s outside professionals for a specific expertise. The Company hires highly qualified professionals to work on the Company’s outside proceedings and real estate investment transactions. The Company’s management works closely with these professionals, assisting in the management of the proceedings and interacting with the professionals on a regular basis.

In setting compensation, the Personnel Committee considers the risks to our stockholders and to the achievement of the Company’s goals that may be inherent in our compensation programs. The Personnel Committee concluded that the Company’s compensation programs are designed with the appropriate balance of risk and reward to align employeesemployees’ interests with those of the Company and our overall business, and do not incent employees to take unnecessary or excessive risks. Although a portion of executive compensation is performance based and “at-risk” we believe our executive compensation plans are appropriately structured and are not reasonably likely to result in a material adverse effect on the Company.

Code of Ethics

We have adopted a Code of Ethics that applies to our Chief Executive Officer, Chief Financial Officer, and other senior officers as well as all employees with respect to policies and procedures relating to trading in the Company’s securities. A copy of the Code of Ethics was filed with the SEC as Exhibit 14 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Insider Trading Policies and Procedures

The Company’s Code of Ethics includes insider trading policies and procedures governing the purchase, sale, and/or other dispositions of the Company’s securities by directors, officers, and employees. The Code of Ethics requires compliance with all applicable laws, rules and regulations governing the offer and sale of securities and prohibits directors, officers, and employees from engaging in transactions in the Company’s securities while in possession of material nonpublic information until at least two trading days have elapsed from the date of public announcement of such nonpublic information. The Company has designated a compliance officer under the Code of Ethics to oversee compliance with and enforcement of the Code of Ethics, including the insider trading provisions.

INDEPENDENT REGISTERED PUBLIC ACCOUNTANT MATTERS

Report of the Accounting and Audit Committee

As set forth in more detail in the Accounting and Audit Committee (the “Audit Committee”) charter (which was included as Exhibit A to the Company’s 20192023 Proxy Statement), the primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its responsibility to oversee management’s conduct of the Company’s financial reporting process, including the oversight of the following:

● | financial reports and other financial information provided by the Company to any governmental or regulatory body, the public or other users thereof; | |

● | the Company’s internal accounting and financial controls over financial reporting; and | |

● | the annual independent audit of the Company’s financial statements. | |

The Audit Committee reviewed the Company’s audited financial statements and met with both Company management and Marcum LLP, the Company’s independent registered public accounting firm, to discuss those financial statements. Management has represented to us that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The Audit Committee has received from and discussed with Marcum LLP the written disclosure and the letter required by applicable requirements of the Public Company Accounting Oversight Board the (“PCAOB”) regarding that firm’s independence from the Company. The Audit Committee also discussed with Marcum LLP any matters required to be discussed by the applicable requirements of the PCAOB, as may be modified or supplemented.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 20202023, and filed with the SEC.

Audit Committee: | | |

Jerry Y. Carnegie, Chairman | | |

Alessandra F. Bianco | | |

KennethScott M. SchmidtSalant

| | |

| | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee appointed Marcum LLP (“Marcum”) as the Company’s principal accountants and independent registered public accounting firm, to audit the consolidated financial statements of the Company for the year ended December 31, 2021.2023. A representative of Marcum will be present at the meeting and will have the opportunity to make a statement if such representative desires to do so and will be available to respond to appropriate questions.

Audit Fees

Aggregate fees billed by Marcum for professional services rendered for the audit of our annual consolidated financial statements included in the Annual Report on Form 10-K, the review of interim consolidated financial statements included in Quarterly Reports on Form 10-Q and the review and audit of the application of new accounting pronouncements and SEC releases were approximately $65,000$72,000 for the year ended December 31, 20202023 and approximately $64,000$69,000 for the year ended December 31, 2019.2022.

Audit Related Fees

No audit related fees were paid to either Marcum for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and that are not disclosed under “Audit Fees” for the years ended December 31, 20202023, and 2019.2022.

Tax Fees and All Other Fees

No other fees relating to tax advisory or other services were paid to Marcum for professional services rendered to the Company for the years ended December 31, 20202023, and 2019.2022.

Audit Committee Pre-Approval Policy

Pursuant to its charter, the Audit Committee is responsible for selecting, approving compensation and overseeing the independence, qualifications and performance of the Company’s independent accountants. The Audit Committee has adopted a pre-approval policy pursuant to which certain permissible audit and non-audit services may be provided by the independent accountants. Pre-approval is generally provided for up to one year, is detailed as to the particular service or category of services and may be subject to a specific budget. The Audit Committee may also pre-approve particular services on a case-by-case basis. In assessing requests for services by the Company’s independent accountants, the Audit Committee considers whether such services are consistent with the auditor’s independence; whether the Company’s independent accountants are likely to provide the most effective and efficient service based upon their familiarity with the Company; and whether the service could enhance our ability to manage or control risk or improve audit quality.

There were no non audit-relatednon-audit related tax or other services provided by Marcum in fiscal years 20202023 and 2019.2022.

COMPENSATION NARRATIVE

The following compensation narrative describes the material elements of compensation for the Company’s officers identified in the Summary Compensation Table (“Named Executive Officers”). As more fully described above herein, the Personnel Committee consists of two independent directors of the Company.

The Personnel Committee is responsible for establishing the Company’s compensation programs, including benefit plans, retirement plans and the Company’s stock option program, including approving the granting of stock option awards to the Company’s officers and employees. The Personnel Committee annually reviews and approves all compensation decisions relating to the Company’s officers, including Named Executive Officers.

The day-to-day design and administration of health, welfare and paid time-off plans and policies applicable to salaried employees in general are handled by the Company’s management. The Personnel Committee is responsible for certain plan design changes outside the day-to-day requirements necessary to maintain these plans and policies.

The Personnel Committee has the ability to, and may from time to time, utilize the services of independent compensation consultants or other outside advisors in reviewing the Company’s compensation programs, as it deems necessary. The Personnel Committee did not utilize the services of any compensation consultants in 2020.2023.

Objectives of the Compensation Program

The Personnel Committee’s overall objective in administering the Company’s compensation programs is to attract, motivate and retain qualified personnel, reward corporate performance and recognize individual contributions on both a short-term and long-term basis. The Personnel Committee seeks to align the interests of these executives with those of the Company’s stockholders by encouraging stock ownership by executive officers to promote a proprietary interest in the Company’s success and to provide incentives to achieve the Company’s goals. In furtherance of these objectives, the Company’s executive compensation policies are designed to focus the executive officers on the Company’s goals. The Personnel Committee determines salary, bonuses and equity incentives based upon the performance of the individual executive officer and the Company. Management compensation is intended to be set at levels that the Personnel Committee believes fully reflect the challenges confronted by management.

The Company strives to provide a combined, overall competitive salary and benefits package, including annual cash bonus incentives, to retain qualified personnel who are familiar with the Company’s operations and critical to the long-term success of the Company. The Company rewards personnel for contributions to a variety of matters, including the pursuit of claims, recovery of claims, compromising of actual and contingent liabilities, and attention to the maintenance of a controlled level of expenditures. Cash bonus incentives are utilized to reward above average corporate performance and recognize individual initiative and achievements which provide immediate and/or long-term value to the Company. Due to the nature of the Company’s operations, which are focused on the recovery of assets, with an emphasis on the 111 West 57th legal proceedings and a previous emphasis on the recovery of the Company’s investment in Carteret through the Supervisory Goodwill litigation (which was settled in October 2012, pursuant to which the Company received a settlement award of $180,650,000), the minimization of the income tax impact of settlement awards, and other proceedings, the Personnel Committee has continued its strategy of compensation through programs that provide an incentive for performance and for contributions to the Company’s operations and efforts to realize recoveries, achieve asset appreciation, eliminate liabilities and control costs.

Elements of Compensation

The Company’s total compensation program for its officers consists of competitive market salaries, annual cash bonus awards, other benefits such as health and other insurance programs, a retirement plan in the form of a 401(k) Savings Plan, which is a qualified plan within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”) and may include stock option or other equity awards.

Due to cost considerations, administrative requirements and as part of an overall compensation philosophy, the Company seeks to maintain a minimal level of benefit programs and other perquisites. Section 162(m) of the Code, as amended, imposes a limitation on the deduction for certain executive officers’ compensation. The Company has paid in the past, and reserves the right to pay in the future, compensation that is not deductible if it believes it is in the best interests of the Company. The Personnel Committee considered the provisions of Section 162(m) with regard to compensation paid for 2020.2023.

Base Annual Salary

Base annual salaries for Named Executive Officers are determined initially by evaluating the responsibilities of the position, the experience of the individual and the competition in the marketplace for management talent, and also may include comparison with companies confronting problems of the magnitude and complexity faced by the Company.

Base annual salaries are intended to be competitive with the overall market place,marketplace, commensurate with the qualifications and experience of the Named Executive Officer. The Company’s compensation structure is intended to provide the necessary incentive to retain and motivate qualified personnel. Individuals are encouraged to add value and provide benefit in all aspects of the Company’s operations currently and in the future.

Base annual salaries and salary adjustments are evaluated on a number of factors, both internal and external in nature. The most important factor is the executive’s performance and contribution to the Company, followed by the performance of the Company, any increased responsibilities assumed by the executive and the competition in the marketplace for similarly experienced executives.

The salaries of the Named Executive Officers are reviewed on an annual basis, typically at the end of each year and may also be adjusted from time to time based on changes in responsibilities, changes in benefit programs or as a result of other external and economic factors. During 2020, Mr. R.A. Bianco’sNo salary was decreasedchanges were made to $440,000 per year from $500,000 per yearthe Company’s executive officers during 2023 and Mr. Ferrara received an increase in his base annual salary to $235,000 per year from $200,000 per year. No other executive officer received a salary increase in 2020. During 2019, Mr. Ferrara received an increase in his base annual salary to $200,000 per year from $175,000 per year.2022.

Annual Bonus Awards

The Company paid no bonuses for 20202023 and 2022 to Mr. R. A. Bianco, of $200,000; Mr. Ferrara of $200,000; andor Mr. J. Bianco of $100,000. Bonus amounts for 2020 were based on various considerations, including work related to the additional AMT Tax Credits realized in 2020, including improved liquidity. Other considerations included longevity of employees with the Company and the performance throughout the year on various matters. During 2019, cash bonuses of $425,000 for Richard A. Bianco, $690,000 for John Ferrara; and $175,000 for Joseph R. Bianco were paid by the Company.Bianco.

Participation Interest

On June 28, 2013, the Company, through a newly formed subsidiary, purchased an equity interest in a real estate development property through a joint venture agreement to purchase and develop real property located at 105 through 111 West 57th Street in New York, New York (the “111 West 57th Property”), as further described under the heading “Operating Agreement of 111 West 57th Investment LLC.” The Company’s interests in the joint venture are held through 111 West 57th Investment LLC (the “Investment LLC”).

In March 2014, the Company entered into an amended and restated operating agreement for the Investment LLC (the “Amended and Restated Investment Operating Agreement”) to grant a 10% subordinated participation interest in the Investment LLC to Mr. R. A. Bianco as incentive compensation for Mr. R. A. Bianco’s past, current and anticipated ongoing role to develop and commercialize the Company’s equity investment in the 111 West 57th Property. Pursuant to the terms of the Amended and Restated Investment Operating Agreement, Mr. R. A. Bianco has no voting rights with respect to his interest in the Investment LLC, and his right to receive 10% of the distributions from the Investment LLC is subject to the Company first receiving distributions equal to 150% of the Company’s initial aggregate $57,250,000 investment in the Investment LLC, plus any additional investments by the Company if any, and only with respect to any distributions thereafter.

The Board of Directors approved the Company entering into the Amended and Restated Investment Operating Agreement with Mr. R.A. Bianco. Mr. R.A. Bianco, Mr. Bianco Jr. and Ms. Bianco recused themselves from the deliberations and voting of the Board of Directors in considering the Amended and Restated Investment Operating Agreement.

12

Litigation Funding Agreement

In September 2017, the Company entered into a Litigation Funding Agreement (the “LFA”) with Mr. R. A. Bianco. Pursuant to the LFA, Mr. R. A. Bianco agreed to provide litigation funding to the Company, up to an aggregate amount of seven million dollars ($7,000,000) (the “Litigation Fund Amount”) to satisfy actual documented litigation costs and expenses of the Company, including attorneys’ fees, expert witness fees, consulting fees and disbursements in connection with the Company’s legal proceedings relating to the Company’s equity investment in the 111 West 57th Property.

After receiving substantial AMT credit carryforward refunds in March 2019, in light of the Company’s improved liquidity, in April 2019 the Company’s Board of Directors (the “Board”) authorized the establishment of a Special Committee of the Board (the “Special Committee”) to evaluate and negotiate possible changes to the LFA. The Special Committee was comprised of Mr. Schmidt and Mr. Carnegie.

On May 20,In 2019, after receiving approval from the Special Committee, the Company and Mr. R. A. Bianco entered into an amendment to the LFA (the “Amendment”) which provides for the following: (i) the repayment of $3,672,000 in funds previously provided to the Company by Mr. R. A. Bianco pursuant to the LFA (the “Advanced Amount”), (ii) the release of Mr. R. A. Bianco from all further funding obligations under the LFA, and (iii) a modification of the relative distribution between Mr. R. A. Bianco and the Company of any Litigation Proceeds received by the Company from the 111 West 57th Litigation, as described below.

The Amendment provides that, in the event that the Company receives any Litigation Proceeds from the 111 West 57th Litigation, such Litigation Proceeds shall be distributed as follows:

| (i) | first, 100% to the Company in an amount equal to the lesser of (a) the amount of actual litigation expenses incurred by the Company with respect to the Company’s 111 West 57th Litigation (including the Advanced Amount); or (b) $7,500,000; and |

| (ii) | thereafter, any additional amounts shall be distributed (a) 75% to the Company and (b) 25% to the Mr. R. A. Bianco (a reduction of Mr. R.A. Bianco’s percentage, which under the terms of the original LFA prior to the Amendment would have been 30% to 45% based on the length of time of any recovery). |

The Special Committee was dissolved in August 2019.

2007 Employment Agreement with the Company’s President and Chief Executive Officer

An employment agreement, as amended, is in effect between Mr. R. A. Bianco and the Company (the “2007 Employment Agreement”), which provides for him to serve as Chairman, President and Chief Executive Officer of the Company through May 31, 2023.2028. The employment agreement also provides for additional benefits, including his participation in various employment benefit plans and annual bonus eligibility for work performed on non-Supervisory Goodwill activities.

During 2006, the Company entered into an employment agreement with Mr. R. A. Bianco (the “2007 Employment Agreement”). As part of the 2007 Employment Agreement terms: (i) Mr. R. A. Bianco’s annual rate of base salary was $625,000 per year during the first three years of the 2007 Employment Agreement with the amount of Mr. R. A. Bianco’s base salary for subsequent years to be determined by the Personnel Committee, in its sole discretion; and (ii) Mr. R. A. Bianco’s annual bonus opportunity each year was no longer linked to recovery efforts in connection with the Company’s Supervisory Goodwill litigation. Instead, the Company and Mr. R. A. Bianco agreed to a long term incentive bonus formula, at varying percentages ranging from 5% to 10%, or more, based upon recoveries received by the Company for its investment in Carteret, through litigation or otherwise (including the Company’s Supervisory Goodwill litigation).

Retirement/Pension Benefits

401(k) Savings Plan

The only retirement type plan maintained by the Company is the Company’s 401(k) Savings Plan (the “Savings Plan”). Pursuant to the terms of the Savings Plan, employees can make contributions which are 33%100% matched by the Company. The employee and the employer matching contribution are subject to the maximum limitations as set forth in the Internal Revenue Code of 1986, as amended.

The Company’s matching contributions to the Savings Plan on behalf of the Named Executive Officers aggregated approximately $78,000$90,000 in 20202023 and $25,000$81,000 in 2019.2022.

Other Benefits

The Company provides only a limited number of additional benefits and perquisites. Such additional items, to the extent provided, are included as Other Compensation in the Summary Compensation table presented herein. The benefits and other perquisites are reasonably consistent with general competitive market practices.

Items provided by the Company include, depending on the Named Executive Officer, Company paid term life insurance at up to two times the individual’s base annual salary, Company paid long-term disability insurance with a monthly benefit up to 60% of the individual’s base monthly salary, supplemental medical and dental coverage for costs not covered under the base health insurance plans, and depending on the Named Executive Officer, reimbursement for income tax services and Company provided transportation. Health and welfare plans are provided through outside insurance carriers. Benefits generally available to all full-time employees of the Company are not included herein.

The Company does not provide any other type of deferred compensation programs, nor does it provide or have outstanding loans with the Named Executive Officers or any other employee of the Company.

Personnel Committee Summary

The Personnel Committee believes that its compensation programs, mixing equity and cash incentives, will continue to focus the efforts of the Company’s executive officers on long-term growth for the benefit of the Company and its stockholders. The Personnel Committee has found all the components of Company’s officers’ compensation to be fair, reasonable and appropriate.

EXECUTIVE COMPENSATION

The following table sets forth the information regarding compensation earned by the Chief Executive Officer and each other executive officer of the Company and its subsidiaries (the “Named Executive Officers”) with respect to services rendered to the Company in the fiscal years ended December 31, 20202023, and December 31, 2019:2022:

Summary Compensation Table (a)

| Name and Principal Position | | Year | | | ($) Salary | | | ($) Bonus | | | ($) (c) All Other Compensation | | | ($) Total | | Year | | ($) Salary | | | ($) Bonus | | | ($) (c) All Other Compensation | | ($) Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard A. Bianco, Chairman | | 2020 | | $ | 440,000 | | $ | 200,000 | | $ | 92,142 | | $ | 732,142 | | 2023 | | $ | 440,000 | | | $ | - | | | $ | 98,735 | | $ | 538,735 | |

President and Chief Executive | | 2019 | | $ | 500,000 | | $ | 425,000 | | $ | 66,373 | | $ | 991,373 | |

Officer (b) | | | | | | | | | | | | | | | |

President and Chief Executive Officer (b) | | | 2022 | | $ | 440,000 | | | $ | - | | | $ | 94,519 | | $ | 534,519 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

John Ferrara, Vice President | | 2020 | | $ | 235,000 | | $ | 200,000 | | $ | 45,199 | | $ | 480,199 | | 2023 | | $ | 235,000 | | | $ | - | | | $ | 44,324 | | $ | 279,324 | |

Chief Financial Officer & | | 2019 | | $ | 194,000 | | $ | 690,000 | | $ | 27,893 | | $ | 911,893 | |

Controller | | | | | | | | | | | | | | | |

Chief Financial Officer & Controller | | | 2022 | | $ | 235,000 | | | $ | - | | | $ | 41,084 | | $ | 276,084 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Joseph R. Bianco | | 2020 | | $ | 116,000 | | $ | 100,000 | | $ | 42,273 | | $ | 258,273 | | 2023 | | $ | 116,000 | | | $ | - | | | $ | 47,002 | | $ | 163,002 | |

Treasurer | | 2019 | | $ | 116,000 | | $ | 175,000 | | $ | 24,667 | | $ | 315,667 | | 2022 | | $ | 116,000 | | | $ | - | | | $ | 43,774 | | $ | 159,774 | |

(a) | The columns relating to “Stock Option Awards,” “Stock Awards,” “Non-Equity Incentive Plan Compensation,” and “Non-qualified Deferred Compensation Earnings” have been omitted because no compensation required to be reported in these columns were awarded to, earned by, or paid to any of the Named Executive Officers with respect to 20202023 or 2019.2022. |

(b) | See the discussion under the heading “Employment Contracts” below for information relating to the 2007 Employment Agreement between Mr. R. A. Bianco and the Company and the amounts which could be payable to Mr. R. A. Bianco based on value realized by the Company with respect to a gross-up for federal taxes imposed on the settlement amount, if any. |

(c) | All Other Compensation for fiscal year 2020,2023, in the table above consists of the following: |

No stock options, SARs, or any other type of stock award grants were granted to the Named Executive Officers during the year ended December 31, 2020.2023.

The Company does not have any stock options, SARs or other stock award grants outstanding.

The Company has no stock options outstanding; hence, there were no stock options exercised or vested during 2020.2023.

2007 Employment Agreement with the Company’s President and Chief Executive Officer

An employment agreement, as amended, is in effect between Mr. R. A. Bianco and the Company, (the “2007 Employment Agreement”). The terms of the 2007 Employment Agreement provide for Mr. R. A. Bianco to serve as Chairman, President and Chief Executive Officer of the Company. In MarchJanuary 2018, the Company and Mr. R. A. Bianco agreed to an amendment to Mr. Bianco’s Employment Agreement with the Company, to extend the term of Mr. R. A. Bianco’s employment with the Company to May 31, 20232028 from May 31, 20182023 (the “Employment Period”). Under the terms of the 2007 Employment Agreement, Mr. R. A. Bianco was entitled to receive an annual base salary of $625,000 for the first three (3) years and was then eligible for discretionary increases to the amount of his base salary in subsequent years. The 2007 Employment Agreement provides for discretionary annual bonuses (which may not take into consideration his efforts to obtain a recovery for the Company of its investment in Carteret Savings), employee benefit plans participation, and certain long-term disability benefits. The 2007 Employment Agreement provides a long-term incentive arrangement for Mr. R. A. Bianco (the “Long-Term Incentive Award”); based upon receipt by the Company of a recovery of its investment in Carteret Savings through litigation or otherwise (including the Company’s Supervisory Goodwill litigation) (the “Recovery Amount”), Mr. R. A. Bianco would receive, with certain exceptions, a lump-sum payment equal to a percentage of that recovery, as follows:

Pursuant to the terms of the 2007 Employment Agreement between Mr. R. A. Bianco and the Company as amended, and the receipt by the Company of $180,650,000 as part of the Supervisory Goodwill legal proceedings Settlement Agreement, in 2012 Mr. R. A. Bianco received a bonus payment as calculated in accordance with the 2007 Employment Agreement. Additional amount(s)amounts to be determined could be due to Mr. R. A. Bianco pursuant to the 2007 Employment Agreement, based on value realized by the Company with respect to a gross-up for federal taxes imposed on the settlement amount, if any.

Under the terms of the 2007 Employment Agreement, if no recovery has been obtained by the Company by the expiration of the 2007 Employment Agreement, the Company and Mr. R. A. Bianco could enter into a consulting arrangement pursuant to which, following his employment with the Company, he would continue to provide services to the Company as an independent contractor, solely for the purpose of assisting the Company in obtaining such a recovery.

Any further Long-Term Incentive Award to Mr. R. A. Bianco is to be paid in the future (i.e., whether during or after the Employment Period and/or the Consulting Period) except if Mr. R. A. Bianco willfully refuses to cooperate in a reasonable fashion with the Company and/or the Board in connection with the Company’s efforts to obtain a Recovery Amount, in which case he would forfeit his entitlement to receive any further Long-Term Incentive Award.

During the Employment Period, if Mr. R. A. Bianco voluntarily resigns or has his employment with the Company terminated by the Company for cause (as set forth in the 2007 Employment Agreement), Mr. R. A. Bianco will forfeit his entitlement to receive any further Long-Term Incentive Award. If Mr. R. A. Bianco becomes disabled (as set forth in the 2007 Employment Agreement) or dies, Mr. R. A. Bianco or his estate, as applicable, would be entitled to receive any further Long-Term Incentive Award upon the Company’s receipt of the Recovery Amount, regardless of when the Recovery Amount is received by the Company. If the Company terminates Mr. R. A. Bianco’s employment with the Company without cause, Mr. R. A. Bianco or his estate, as applicable would be entitled to receive any further Long-Term Incentive Award upon the Company’s receipt of the Recovery Amount, regardless of when the Recovery Amount is received by the Company.

Mr. R. A. Bianco’s employment under the 2007 Employment Agreement automatically terminates if Mr. R. A. Bianco dies during the term of the Employment Period and can be terminated by the Company at its option for cause (as set forth in the 2007 Employment Agreement) or Mr. R. A. Bianco’s inability to engage in any substantial gainful activity (as set forth in the 2007 Employment Agreement).

In the event the Company terminates Mr. R. A. Bianco’s employment for any reason other than those permitted pursuant to the 2007 Employment Agreement, Mr. R. A. Bianco would be entitled to receive a lump-sum amount equal to the salary payments provided for in the 2007 Employment Agreement for the remaining term thereof, following the passage of a six (6) month period from the date of his termination. As of December 31, 2020,2023, the aggregate lump-sum amount of such salary payments, pursuant to the 2007 Employment Agreement as amended, would be approximately $1,510,000.$2,760,000.

The JV Agreement and related operating agreements generally provide that all distributable cash shall be distributed as follows: (i) first, 100% to the members in proportion to their percentage interests until Investment LLC has received distributions yielding a 20% internal rate of return as calculated; (ii) second, 100% to the Sponsor as a return of (but not a return on) any additional capital contributions made by the Sponsor on account of manager overruns; and (iii) thereafter, (a) 50% to the members in proportion to their respective percentage interests at the time of such distribution, and (b) 50% to the Sponsor.

During 2014, in connection with the funding of additional capital calls under the JV Agreement for required borrowing and development costs for the 111 West 57th Property, the Company’s management and its Board of Directors concluded that, given the continuing development risks of the 111 West 57th Property and the Company’s financial position, the Company should not at that time increase its already significant concentration and risk exposure to the 111 West 57th Property. Nonetheless, the Company sought to limit dilution of its interest in the Joint Venture resulting from any failure to fund the capital call requirements, but at the same time wished to avoid the time, expense and financial return requirements (with attendant dilution and possible loss of voting rights) that obtaining a replacement third-party investor would require. The Company therefore entered into a second amended and restated operating agreement for Investment LLC (“Second Amended and Restated Investment Operating Agreement”) pursuant to which Capital LLC was admitted as a member of Investment LLC. In exchange for Capital LLC contributing toward Investment LLC capital calls in respect of the 111 West 57th Property, available cash of Investment LLC will be distributed first to Capital LLC until it has received a 20% internal rate of return (calculated as provided for in the JV Agreement as noted above), second to the Company until it has received 150% of its capital, and, thereafter, available cash is split 10/90, with 10% going to Mr. R. A. Bianco as the subordinated participation interest noted above and 90% going to Capital LLC and the Company pari-passu, with Capital LLC receiving one-half of its pro-rata share based on capital contributed and the Company receiving the balance. No other material changes were made to the Amended and Restated Investment Operating Agreement, and neither Mr. R. A. Bianco nor Capital LLC has any voting rights with respect to their interest and investment in Investment LLC.

Because of time constraints, concerns regarding the potential level of any financial dilution, complications relating to structure of the investments in the Joint Venture, bank constraints and potential loss of voting rights over the Joint Venture, the terms of Capital LLC’s admission to and investment in the Investment LLC were reviewed by the Board of Directors and determined to be no less favorable to the Company than would have been obtained in negotiations with a third party unaffiliated with the Company, even assuming that any such third party investor was available and prepared to fund under the time constraints imposed by the JV Agreement. Based in part on such determination, the Board of Directors unanimously approved the admission of Capital LLC to Investment LLC on the terms described by a vote of the disinterested members of the Board of Directors. In April 2015, Capital LLC contributed an additional amount toward Investment LLC capital calls in respect of the 111 West 57th Property.

In July 2015, based on available net proceeds received from the financing and equity previously invested in the project, funds were distributed to the members of 111 West 57th Partners (the “July 2015 Distribution”). As part of the July 2015 Distribution, in accordance with the Second Amended and Restated Investment Operating Agreement as noted herein, the Company through Investment LLC repaid Capital LLC the full amount of its capital contributions of $9,868,000. Additional amounts may still be payable to Capital LLC based on investment returns received on the 111 West 57th Property as further described herein.

Other than the Company’s 401(k) Savings Plan, the Company maintains no other retirement or deferred compensation type plans.

The Company does not maintain any other type of nonqualified deferred compensation plan.

Other than Mr. R. A. Bianco, there are no employment agreements or employment contracts with any other officer or employee of the Company. See Employment Contracts above, for information concerning potential payments due to Mr. R. A. Bianco upon termination, pursuant to the employment agreement between Mr. R. A. Bianco and the Company.

The Company does not have any severance or termination payment plans in effect.

The annual fee paid to each director of the Company, including Mr. R. A. Bianco, who is the Company’s Chairman, President and Chief Executive Officer, is $12,000 per year. Mr. R. A. Bianco elected not to receive his annual director fee for 2020.2023. In addition, each Chairperson and/or Co-Chairperson of a Board committee is paid an additional fee of $1,000 per year, and after four (4) Board and/or committee meetings, each director is paid a $500 per meeting attendance fee. Pursuant to the Company’s By-Laws, directors may be compensated for additional services for the Board of Directors or for any committee at the request of the Chairman of the Board or the Chairman of any committee.

Details of amounts paid to the Company’s directors in their capacities as directors and/or board committee members for the year ending December 31, 2020,2023, is as follows: